CATHERINE REAGAN and ROBERT GOWER, March 30, 2023

For employers operating in California who are considering alternatives to the CalSavers program, there are a number of qualified employee benefit plan options that may be a good fit. CalSavers is a program created by state law to help California residents save money for retirement. Today, most employers with five or more California-based employees are required to register their employees for the CalSavers program unless they offer a qualified plan. In 2022, the California legislature amended the CalSavers program to require employers with one or more California-based employees to either register for the CalSavers program or file an exemption by December 31, 2025. This article provides an overview of the CalSavers program and a summary of the defined contribution qualified plans that employers may offer in lieu of participation in CalSavers.

I. What Is the CalSavers Program?

In response to growing concern that many California residents were not adequately saving for retirement, in 2012, the California legislature passed the California Secure Choice Retirement Savings Trust Act, which created the CalSavers program. Studies have shown that individuals are significantly more likely to save for retirement if they are automatically enrolled in a retirement savings program. CalSavers was designed to ensure that all working Californians have a path to financial security in retirement, even if their employers do not offer retirement plans. After the program survived a legal challenge by the Howard Jarvis Taxpayers Association, which alleged CalSavers was preempted by the Employee Retirement Income Security Act of 1974 (ERISA), the CalSavers program took effect in phases, with most employers required to register or file their exemption by June 2022. Under the CalSavers program, Eligible Employees’ contributions are held in Roth Individual Retirement Accounts (Roth IRAs). This program is administered by the CalSavers Retirement Savings Board, an agency of the State of California. The CalSavers Retirement Savings Board selects the investment options, which include target date retirement funds, an environmental, social and governance (ESG) fund, a core bond fund, a global equity fund, and a money market fund. As of January 31, 2023, CalSavers included more than 117,000 employers, 403,000 employees, and $423,000,000 in total assets. This program is offered to California residents at no cost to taxpayers, as all of the administrative costs are paid by the individual savers through fees allocated proportionally to their assets in the program.

Who Is an Eligible Employer and What Are Their Obligations?

Employers with an average of at least five California-based employees (at least one of whom is over 18) are eligible employers and must register for the CalSavers program or file an exemption. The average number of employees is calculated using the number of employees reported to the Employment Development Department (EDD) on the Quarterly Contribution Return and Report of Wages (DE 9) and the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) filings from the prior year, rounding for fractions. Note: Employers with an average of one to four California-based employees must register for CalSavers or file their exemption by December 31, 2025. Employers are exempt from the program if they do not employ any individual other than the owner, they are a government entity, religious entity, or tribal organization, or they offer a qualified retirement plan. The eligible qualified plans that would exempt an employer from CalSavers are discussed further below.

When an employer registers for CalSavers, they must provide information regarding their eligible employees. Eligible employers also have an ongoing obligation to provide information regarding eligible new employees within 30 days of their hire date. Eligible employees are then automatically enrolled in CalSavers, with contributions set at 5% of compensation, after tax. Those contribution amounts increase annually by 1% up to 8% of compensation. The employees can opt out or change their contribution amounts by contacting CalSavers directly. Eligible employers are responsible for deducting contributions each pay period, and must remit those funds within 7 days. Eligible employers do not have to send notices to their employees; CalSavers contacts the employees directly to provide information about the program.

If an employer fails to timely register or file an exemption, they will receive a notice of their failure to comply. If they do not comply or otherwise file an exemption within 90 days of receiving that notice, employers are subject to penalties of $250 per employee. If they do not correct the issue after 180 days or more after receiving the notice, employers are subject to an additional penalty of $500 per employee .

Which Employers Are Exempt from CalSavers?

Employers are exempt from the program if they sponsor an eligible qualified retirement plan, including ERISA plans created under the following Internal Revenue Code (IRC) Sections:

- IRC Section 401(a) — Qualified Plans (including profit-sharing plans and defined benefit plans);

- IRC Section 401(k) plans, including multiple employer plans (MEPs) or pooled employer plans (PEPs);

- IRC Section 403(a) — Qualified Annuity Plans or 403(b) Tax-Sheltered Annuity Plans;

- IRC Section 408(k) — Simplified Employee Pension (SEP) plans;

- IRC Section 408(p) — Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) IRA Plans; and

- Payroll deduction IRAs with automatic enrollment.

For employers that are part of a controlled group of businesses, if one of the controlled group members sponsors a qualified plan, then all of the employers in the controlled group are exempt from CalSavers. This applies even if the employer does not participate in the controlled group plan. However, all employers in the controlled group must independently determine whether they are an Eligible Employer based on their own average number of California-based employees. All employers must also individually register or file an exemption from CalSavers.

TRUCKER HUSS COMMENT ON SECTION 1: Each employer should decide whether CalSavers or another qualified plan alternative is the right choice for their business. There are advantages to enrolling in the CalSavers program; but there are also advantages to offering eligible qualified plans instead. The CalSavers program is easy to enroll in,and there is no cost to employers to administer the program. Employers only need to provide information for new employees and remit contributions every pay period. Also, employers may be able to work with payroll providers to remit contributions on their behalf. Unlike qualified retirement plans, there is no fiduciary liability for employers in the CalSavers program and the program is not subject to annual filings, such as the Form 5500. However, in the CalSavers program, employers and their employees are not able to use the tax advantages available with some of the qualified retirement plan alternatives, such as pre-tax contributions, employer contributions (including profit sharing contributions and matching contributions), the small business tax deductions for creating a new retirement plan, and higher contribution and income limits. For example, CalSavers contributions are subject to Roth IRA contribution limits (for 2023: $6,500, and $7,500 for employees over the age of 50). For employers with employees earning more than $153,000 ($228,000 if married, filing jointly), highly compensated employees will not be able to make contributions to the CalSavers program due to IRC compensation limits for Roth IRAs. Employers are also not able to change the investment options available to their employees in CalSavers. For some employers, creating a qualified retirement plan that offers tax advantages to the employer and its employees may be preferrable to participating in CalSavers.

II. What Are the Qualified Retirement Plan Alternatives to CalSavers?

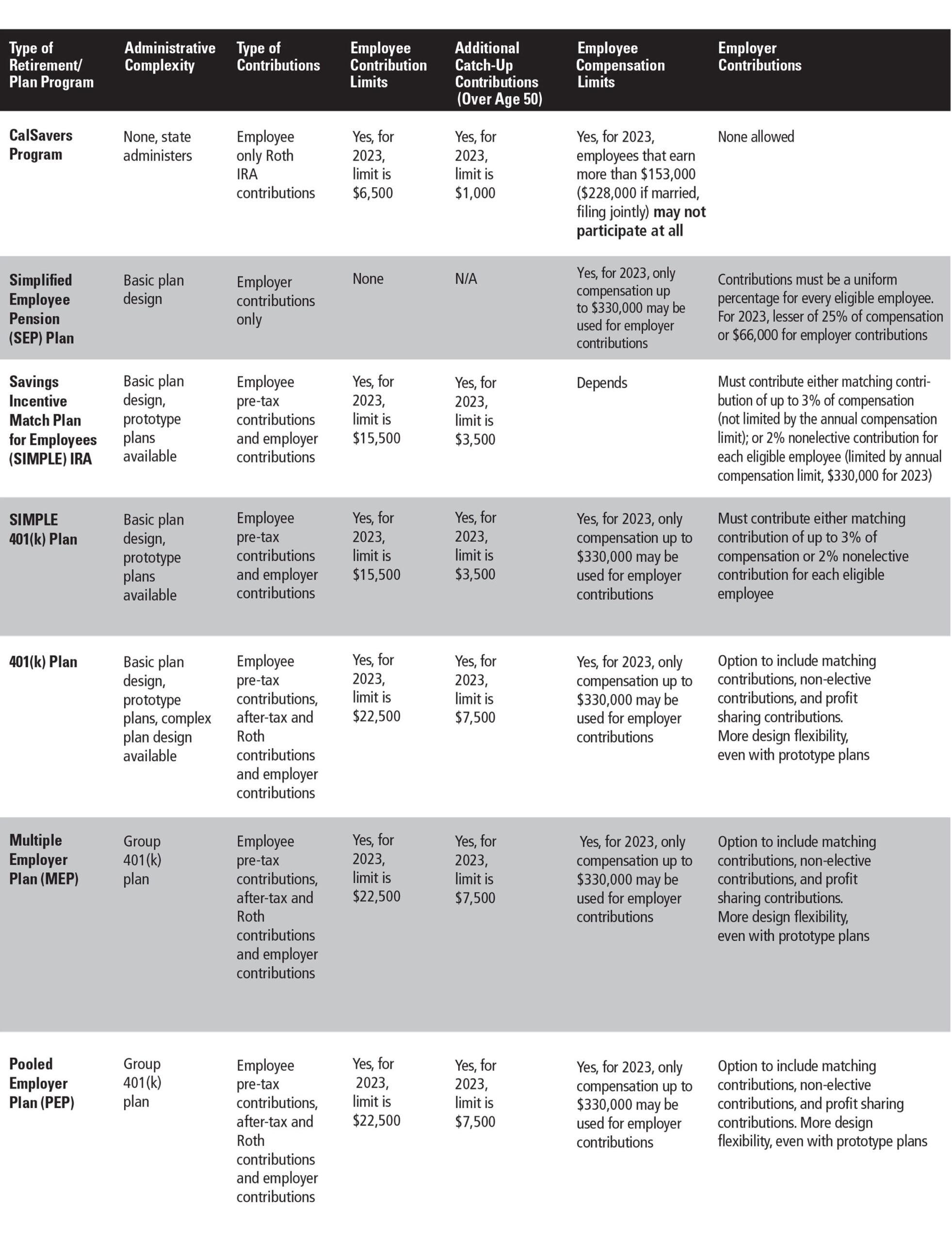

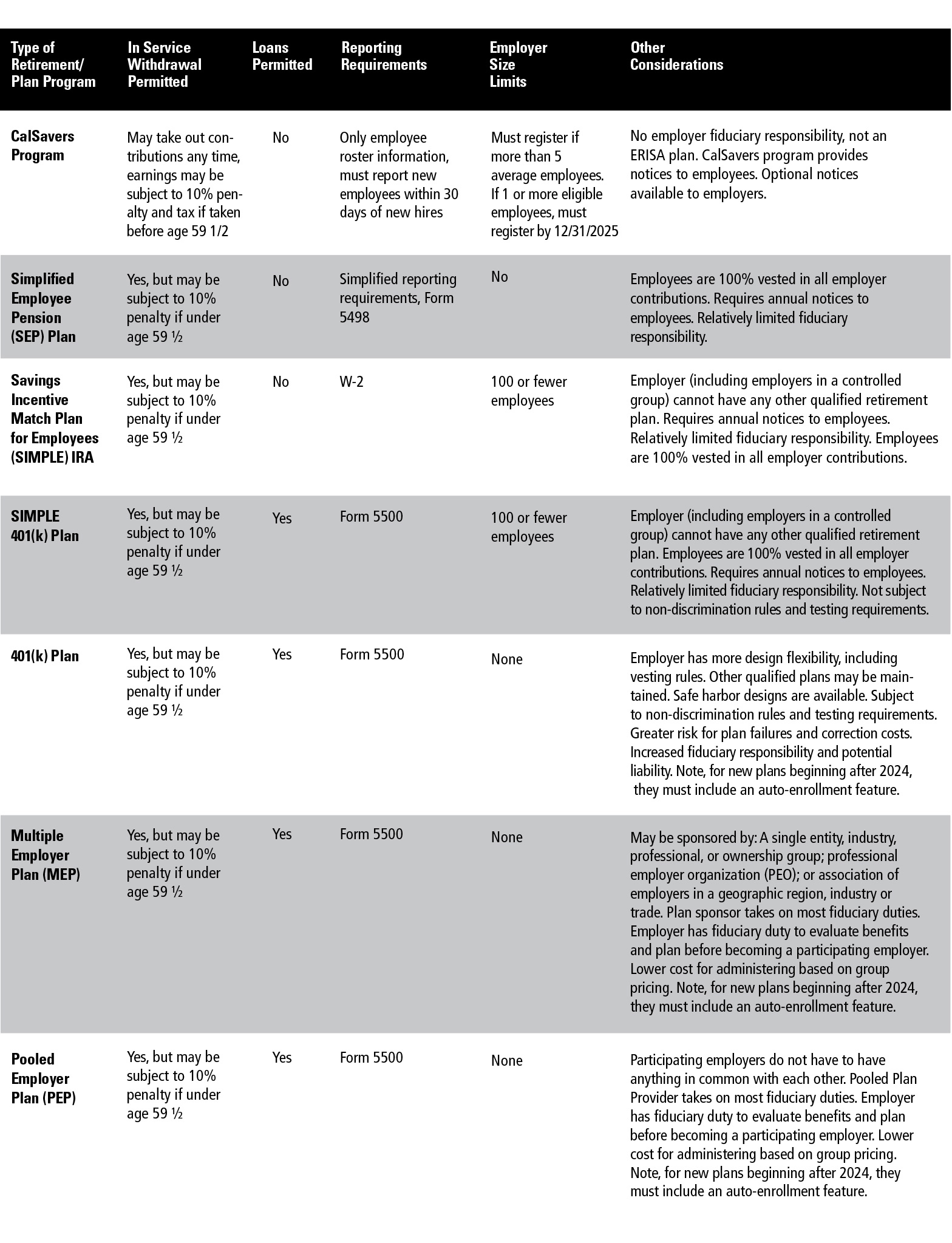

For employers looking for an alternative to the CalSavers program, there are several qualified plan design options available, ranging in complexity from simple and easy-to- administer plans to more complex plans with customizable features, all of which are listed above in Section I. Most qualified retirement plans allow employees to make contributions towards their retirement using both pre-tax and after-tax dollars. Additionally, employers may have flexibility to make employer contributions, depending on the type of qualified plan they choose. There are a number of plan design options available, including various vesting requirement options that promote employee retention. To help businesses select the qualified retirement plan that works best for them, there is a 2-page chart comparing CalSavers with defined contribution plan options at the end of this article. There are also defined benefit plan options available to employers; however, those types of plans are not specifically addressed in this article.

Employers also gain tax advantages by setting up and maintaining qualified plans. For example, employers with 100 or fewer employees may be eligible for the Credit for Small Employer Pension Plan Startup Costs. This credit was expanded by the SECURE Act 2.0, a new law that became effective in December 2022. The Credit for Small Employer Pension Plan Startup Costs is equal to 100% of eligible startup costs for a qualified plan for the first two years, then 75% in the third year, then 50% in the 4th year and 25% in the fifth and final year for the credit. The credit is equal to a maximum of $5,000 — or $100 per participant for up to 50 participants — and is phased out for employers with between 51 to 100 employees. The costs eligible for the credit include the cost to set up and administer a new retirement plan and the cost of educating employees about the plan. Based on recent changes to the law (effective retroactively for plans created after December 31, 2019), this credit is now available to new employers that join an existing Multiple Employer Plan (MEP) or Pooled Employer Plan (PEP) — where another entity may sponsor the plan, and unrelated employers participate for the benefit of their employees.

There are many reasons to create a qualified retirement plan; however, there are also some risks associated with maintaining a qualified plan. All qualified plans are subject to Department of Labor and Internal Revenue Service regulatory schemes, and the plan fiduciaries are responsible for administering the plan in compliance with applicable federal law and guidance. Employers (as a plan sponsor and/or administrator) are subject to ERISA’s fiduciary duties, including the duties of prudence and loyalty. Fiduciaries must act as a reasonably prudent person would, for the exclusive purpose of providing benefits to participants and their beneficiaries, and defraying the reasonable expenses of administering the plan. Plan sponsors and plan fiduciaries also have a fiduciary duty to select service providers for the plan and an ongoing duty to monitor those service providers. To carry out these duties, ERISA plan fiduciaries are expected to retain experts, as needed, to help guide them in maintaining and administering an ERISA plan. If a fiduciary breaches their duty, they may be personally liable to restore losses to the plan. It is important to speak to an expert in ERISA before creating a new plan.

Considerations for Choosing an ERISA Plan or CalSavers

When considering the alternatives discussed in this article, there are several important questions to ask:

- How much do you want to save or to allow your employees to save? If the goal is to allow employees to save more than $6,500 a year, or to allow high- income employees to save, then an ERISA benefit plan may be preferable to CalSavers.

- What is the most attractive option for talent retention? Employers may want to include vesting requirements to encourage employees to stay with the company to maintain institutional knowledge.

- What are the corresponding set-up and maintenance costs associated with each option? CalSavers is administered at no cost to employers, but small employers are able to take advantage of the Credit for Small Employer Pension Plan Startup Costs, which has tax advantages CalSavers does not offer.

- Do you want to make employer contributions? CalSavers does not allow employer contributions, but many of the ERISA plan options do.

- What are your employee population considerations? High-earning employees will not be able to participate in CalSavers, and qualified plan options may provide them with increased savings limits. Therefore, their employers may want to consider an ERISA plan instead.

If an employer is considering which ERISA plan option works best for them, below this article is a 2-page chart highlighting the key differences between the various ERISA defined contribution plan options and CalSavers. See the 2-page chart below.

If you would like more information about these options and how they can be tailored to fit your business needs, one of our Trucker Huss attorneys would be happy to guide you in this process.