YATINDRA PANDYA and ROBERT GOWER, November 30 2023

Introduction

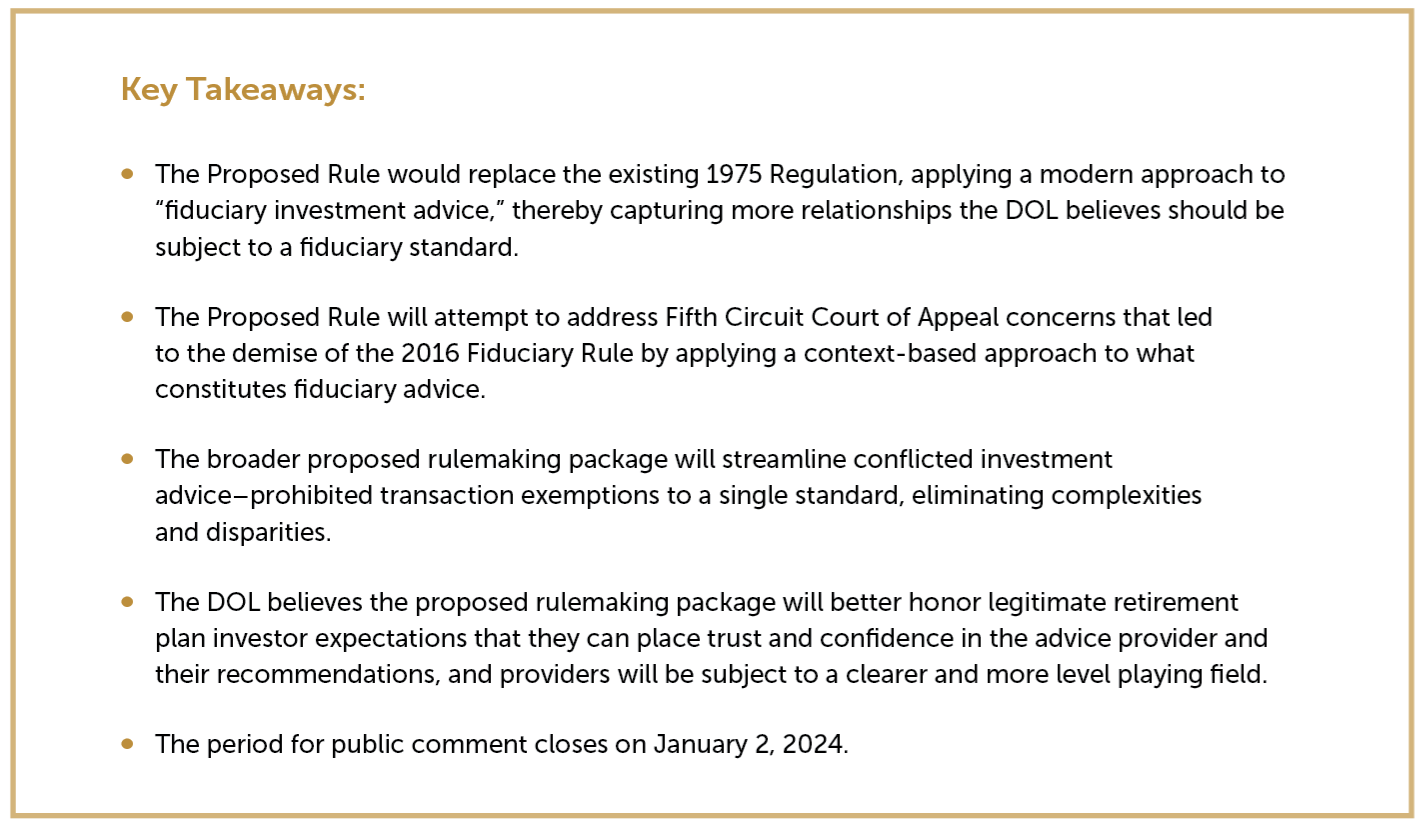

On October 31, 2023, the Department of Labor (DOL) released its proposed rule (the “Proposed Rule”) providing a draft new regulatory definition of an “investment advice fiduciary” under the Employment Retirement Income Security Act of 1974 (ERISA). The Proposed Rule breathes new life into the DOL’s decades-long effort to reform the definition of who may be considered a fiduciary by providing investment advice for a fee or other compensation. The drafting of such a rule is no small feat. Prior attempts ultimately failed, with a 2010 proposed rule being withdrawn by the DOL, and a 2016 final rule (2016 Fiduciary Rule) being vacated by the Fifth Circuit Court of Appeals in 2018.

The challenges in updating the definition of “investment advice fiduciary” are numerous. First, the existing definition is almost 50 years old (issued in 1975) and reflective of a world in which defined benefit plans were dominant. With the vast majority of retirements now housed in participant directed defined contribution plans, reconsiderations are warranted. Simultaneously, there is a desire not to overhaul the definition so extensively that it overcomplicates or overburdens the process of rendering investment advice to the point where rendering advice becomes unfeasible.

In its opinion vacating the 2016 Fiduciary Rule, the Fifth Circuit Court of Appeals reasoned that the DOL swept too broadly in defining “investment advice fiduciary” and extended beyond those “touchstone” relationships necessitating trust and confidence, which are the hallmarks of the common law fiduciary relationship that Congress intended to incorporate into the definition of fiduciary under ERISA. The Proposed Rule aims for permanency by responding directly to the Fifth Circuit’s emphasis on these “touchstone” relationships of trust and confidence — by redefining the concept of an “investment advice fiduciary” through tailored application only if compensated recommendations are made in specified contexts. The DOL’s primary goal in this context-based approach is to build trust and confidence to protect retirement savers through a framework that places investment professionals rendering investment advice on a level playing field with clear and equal application of fiduciary status — a framework the DOL does not believe exists under current regulations.

This article overviews the Proposed Rule, how the Proposed Rule relates to (and differs from) the vacated 2016 Fiduciary Rule, and the perceived impact on investors and investment professionals currently subject to the existing regulatory landscape (the 1975 regulation). The article also addresses related proposed prohibited transaction exemptions which round out the proposed regulatory package, and how the package aims to level the playing field and provide clear and equal application of fiduciary protections in the rendering of investment advice.

The Proposed Rule

The Proposed Rule applies a fiduciary standard where advice is rendered in one of three contexts:

- The person either directly or indirectly (e.g., through or together with any affiliate) has discretionary authority or control, whether or not pursuant to an agreement, arrangement, or understanding, with respect to purchasing or selling securities or other investment property for the retirement investor;

- The person either directly or indirectly (e.g., through or together with any affiliate) makes investment recommendations to investors on a regular basis as part of their business and the recommendation is provided under circumstances indicating that the recommendation is based on the particular needs or individual circumstances of the retirement investor and may be relied upon by the retirement investor as a basis for investment decisions that are in the retirement investor’s best interest; or

- The person making the recommendation represents or acknowledges that they are acting as a fiduciary when making investment recommendations.

A recommendation for these purposes is defined as:

- Recommendations involving securities, other investment property, and investment strategy, including recommendations as to how securities or other investment property should be invested after rollover, transfer, or distribution, and including recommendations on rollovers, benefit distributions, or transfers from plan or IRA;

- Recommendations on strategies, management of securities or other investment property, and account types, including recommendation on the selection of other persons to provide investment advice or investment management; and

- Recommendation regarding proxy voting appurtenant to ownership of shares of corporate stock; 1

For the avoidance of doubt, the Proposed Rule also provides:

- That disclaimers as to an advisor’s fiduciary status will not control to the extent they are inconsistent with the person’s oral communications, marketing materials, applicable State or Federal law, or other interactions with the retirement investor;

- That the regular basis requirement does not preclude one-time advice if the advisor regularly makes investment recommendations to other investors and the regulation’s other conditions are met; and

- That advice “for a fee of or other compensation” is applicable only if the fee or other compensation would not have been paid but for the recommended transaction or the provision of advice, or if the investment advice provider’s eligibility for the compensation (or its amount) is based in whole or part on the recommended transaction or the provision of advice.

Importantly, in addition to a narrowed definition of investment advice, the Proposed Rule makes a number of notable departures from the vacated 2016 Fiduciary Rule to remove some of the cumbersome and complex provisions of that rule:

- There are no new written contract or warranty requirements;

- There are no specific provisions providing leniency for “sophisticated investors.” All advice rendered is subject to the same context-based approach; and

- The Proposed Rule does not affect State laws that regulate insurance, banking or securities that are expressly exempt from ERISA preemption.

Related Proposed Prohibited Transaction Exemptions

In connection with issuing the Proposed Rule, the DOL aims to reduce complexities and disparities in the existing prohibited transaction exemption landscape by providing various fact-and-circumstance based exemptions for potentially conflicted fiduciary advice. To accomplish this goal, the DOL reviewed and proposed numerous revisions to existing prohibited transaction exemptions covering potentially conflicted investment advice. The revisions result in significant steps toward a uniform exemption standard, requiring that investment advice fiduciaries give advice that meets a professional standard of care or duty of prudence that puts the retirement investor first; and it prohibits advisors from charging more than reasonable compensation or misleading investors. Notably, in addition to proposals that unify exemption standards, PTE 2020-02 (Improving Investment Advice for Workers & Retirees), which focuses on fiduciary standards in providing investment advice related to rollovers, would be expanded to also cover transactions involving pooled employer plans (PEPs), and robo-advice transactions, broadening the reach of the uniform standard.

Impact of the Proposed Rule

The Proposed Rule intends to replace the 1975 definition of an investment advice fiduciary (which applies a five-part test for a person to be treated as a fiduciary by reason of rendering investment advice). Under the near fifty-year-old five-part test (which has been in place except for a brief period from 2016 through 2018 when the 2016 Fiduciary Rule was in effect), a person is a fiduciary only if they: (1) render advice as to the value of securities or other property, or make recommendations as to the advisability of investing in, purchasing, or selling securities or other property (2) on a regular basis (3) pursuant to a mutual agreement, arrangement, or understanding with the plan or a plan fiduciary that (4) the advice will serve as a primary basis for investment decisions with respect to plan assets, and that (5) the advice will be individualized based on the particular needs of the plan.

In issuing the Proposed Rule, the DOL explained that over time, the 1975 regulation has worked to defeat, rather than honor, legitimate investor expectations that they can place trust and confidence in the advice provider and their recommendations. Specifically, the DOL believes the Proposed Rule will correct numerous perceived deficiencies in the 1975 regulation, as follows:

- “[A]s a result of the five-part test in the 1975 rule, many investment professionals, consultants, and financial advisers have no obligation to adhere to the fiduciary standards in Title I of ERISA or to the prohibited transaction rules, despite the critical role they play in guiding plan and IRA investments.”

Note: he context-based approach of the Proposed Rule aims to address this by attaching fiduciary status to advice providers not reached by the 1975 regulation but who nonetheless provide advice within a relationship that a reasonable investor expects is trusted. Not only does the Proposed Rule stipulate the circumstances (contexts) where fiduciary status attaches, but it also specifies that a recommendation” includes advice related to rollovers, benefit distributions, or transfers from plan or IRA, and includes advice on investment choices after such rollover, distribution, or transfer, thereby capturing yet more transactions often lost to the 1975 regulation. Moreover, related proposed prohibited transaction exemptions unify standards with respect to robo-advice and transactions involving pooled employer plans.

- “[T]hat specific elements of the five-part test . . . worked to defeat retirement investors’ legitimate expectations when they received investment advice from trusted advice providers in the modern marketplace for financial advice.” For example, “the requirement that advice be provided on a ‘regular basis’ had failed to draw a sensible line between fiduciary and non-fiduciary conduct and had undermined the Act’s protective purpose.”

Note: The Proposed Rule modifies “regular basis” by adding “as part of their business.” In doing so, the DOL focuses on an objective standard of whether the provider is in the business of providing investment recommendations. This works both to overcome concerns the rule would sweep too broadly, and at the same time does not automatically exclude one-time advice from treatment as fiduciary investment advice.

- “[T]he requirements in the 1975 regulation of a ‘mutual agreement, arrangement, or understanding’ that advice would serve as ‘a primary basis for investment decisions’ had encouraged investment advice providers in the current marketplace to use fine print disclaimers as potential means of avoiding ERISA fiduciary status, even as they marketed themselves as providing tailored or individualized advice based on the retirement investor’s best interest.”

Note: Under the Proposed Rule, a disclaimer is not determinative as to fiduciary status. Instead, the rule focuses on the objective circumstances surrounding the recommendation, including how the advisor represents themselves to the retirement investor and describes the services offered. Through this lens, use of such titles as financial consultant, financial planner, and wealth manager would tend

to attach fiduciary status, and according to the DOL, such status would likely not be overcome by a fine print disclaimer to the contrary.

- “[T]he ‘primary basis’ element of the five-part test appeared in tension with the statutory text and purposes of Title I and Title II of ERISA” and a plan “should be able to rely upon any or all of the consultants that it hired to render advice regardless of arguments about whether one could characterize the advice, in some sense, as primary, secondary, or tertiary.”

Note: he Proposed Rule addressed this by removing “primary basis” from the regulatory text. Instead the rule asks whe ther the circumstances indicate that a recommendation can be relied upon by the retirement investor “as a basis for investment decisions that are in the retirement investor’s best interest.” In essence, the rule applies an objective, reasonableness standard as to whether a recommendation can be relied upon by the retirement investor.

Aiming for Permanency

In issuing the Proposed Rule, the DOL looks beyond its vacated 2016 Fiduciary Rule, but also reflects upon lessons learned:

“The Department believes the test that it is proposing here better honors the statute and retirement investors’ legitimate expectations of impartial investment advice from trusted advice providers than the 1975 rule, while avoiding the danger of sweeping too broadly and covering recommendations that Congress might not have intended to cover.”

The DOL references the Fifth Circuit’s vacatur in seeking to avoid the danger of “sweeping too broadly.” Departing from the 2016 Fiduciary Rule, the Proposed Rule attempts to more narrowly tailor the definition of fiduciary and focus on the Fifth Circuit’s emphasis on relationships of trust and confidence. In doing so, the Proposed Rule defines an investment advice fiduciary in a way that would apply fiduciary status to a smaller set of advice relationships than the 2016 Fiduciary Rule, but a broader set than the five-part test. This may not be saying much, as, the DOL concedes, the 2016 Fiduciary Rule applied to virtually all recommendations made to retirement investors. As a general matter it covered:

- recommendations by a person who represents or acknowledges that they are acting as a fiduciary within the meaning of ERISA;

- advice rendered pursuant to a written or verbal agreement, arrangement or understanding that the advice is based on the particular investment needs of the retirement investor; and, most expansively,

- recommendations directed to a specific retirement investor or investors regarding the advisability of a particular investment or management decision with respect to securities or other investment property of the plan or IRA.

The 2016 Fiduciary Rule defined fiduciary advice to include any compensated investment recommendation if it was directed to a specific retirement investor regarding the advisability of a particular investment or management decison with respect to securities or other investment property of the plan or IRA. That is to say, the 2016 Fiduciary Rule looked at the status of the advice recipient, and the nature of the recommendation itself. In contrast, the Proposed Rule provides that fiduciary status will attach only if compensated recommendations are made in certain specified contexts — the idea being that each context describes a circumstance in which the retirement investor can reasonably place their trust and confidence in the advice provider. Through this context-based approach, the Proposed Rule looks at the certain characteristics of the advisor (e.g., whether that person makes advice on a “regular basis as part of their business”). It then looks to the circumstances under which such recommendation is made — asking whether the recommendation is based on the particular needs or individual circumstances of the retirement investor and may be relied upon by the retirement investor as a basis for investment decisions that are in the retirement investor’s best interest — in other words, a recommendation made within a relationship of trust and confidence.

Final Thoughts

The Proposed Rule, multiple years in the making, reflects lessons learned by the Department of Labor from the vacated 2016 Fiduciary Rule. The Proposed Rule is narrower than the 2016 Fiduciary Rule in that it applies only to paid recommendations made in three specified contexts, does not include any new contract or warranty requirement, and focuses on the retiree’s reasonable expectation of a relationship of trust and confidence. At the same time, the Proposed Rule also aims to better capture investment advice relationships not covered by the aging 1975 regulation, expanding and modernizing the definition of Investment Advice Fiduciary to capture investment advice relationships reflective of today’s retirement plan landscape. Steps by the Department of Labor to reject legal disclaimers intended to avoid fiduciary liability and to revise the “regular basis” requirement to focus on business activity as a determinative factor will inevitably result in additional investment professionals being held to a fiduciary standard, as will the inclusion of rollover and PEP–related recommendations. If realized, the rulemaking package will help plan sponsors and participants better understand when investment professionals are acting in a fiduciary capacity, reduce discrepancies in who is held to a fiduciary standard, and more broadly support the interests of plan participants achieving their retirement goals.

Public Comment Period

The period for public comment closes on January 2, 2024. Commentors may submit written comments, identified by RIN 1210–AC02, by either of the following methods:

- Federal

eRulemaking Portal: http://www.regulations.gov.

(Follow the instructions for sending comments.) - Mail

Office of Regulations and Interpretations,

Employee Benefits Security Administration,

Room N–5655, U.S. Department of Labor,

200 Constitution Ave. NW,

Washington, DC 20210,

Attention: Definition of Fiduciary — RIN 1210–AC02

The DOL specifically asks for comment on the following:

- The DOL invites comment on the extent to which the DOL should consider the investor’s understanding as to whether the advisor regularly makes investment recommendations as part of their business.

- The DOL seeks comment regarding examples of financial professionals who may be reasonably viewed by investors as giving investment advice but would not in fact meet the requirements laid out in this provision.

- The DOL invites comments on the extent to which particular titles are commonly perceived to convey that the investment professional is providing individualized recommendations that may be relied upon as a basis for investment decisions in a retirement investor’s best interest (and if not, why such titles are used). The DOL also requests comment on whether other types of conduct, communication, representation, and terms of engagement of investment advice providers should merit similar treatment.

- The DOL seeks comment on the frequency with which employees recommend their products to retirement investors and how they currently ensure such recommendations are prudent to the extent required by ERISA. The DOL invites comments on the magnitude of any such costs and solicits data that would facilitate their quantification in the proposal.

- The DOL welcomes any comments and data that can help estimate the number of rollovers affected by the exemptions.

- The DOL also invites comments about financial services professionals’ practices for documenting rollover recommendations, particularly the extent to which financial services professionals use standardized forms or templates to document the reasons for recommending rollovers and how long on average it would take for a financial

services professional to document a rollover recommendation.

_______________

1 However, guidelines or other information on voting policies for proxies that are provided to a broad class of investors without regard to a client’s individual interests or investment policy and that are not directed or presented as a recommended policy for the plan or IRA to adopt, would not rise to the level of a covered recommendation under the proposal.