MARY E. POWELL, August 31, 2021

On August 20, 2021, the Departments of Labor (DOL), Health and Human Services (HHS) and Treasury (collectively, the Departments), issued Frequently Asked Questions (FAQs) regarding the implementation of certain provisions of the Consolidated Appropriations Act, 2021 (CAA) and the Affordable Care Act (ACA). Fortunately, several of the most complicated and onerous provisions of the CAA have a delayed effective date. That is welcome news to plan sponsors, given the myriad new requirements for group health plans imposed by the CAA — and the relatively short time between its passage on December 27, 2020, and the effective date of most of its provisions (i.e., plan years beginning on or after January 1, 2022). For certain other provisions of the CAA, plan sponsors will be held to a good faith, reasonable interpretation of the law. Those distinctions, as well as the CAA and ACA transparency provisions impacted by these FAQs, are described below in more detail. (For a detailed overview of the group health plan provisions of the CAA and regulations implementing the transparency requirements of the ACA, see this Special Alert.)

Transparency in Coverage — Three Machine-Readable Files (ACA Regulations)

On November 12, 2020, the Departments issued final rules requiring non-grandfathered group health plans to disclose on a public website — in three separate machine-readable files — information regarding in-network provider rates for covered items and services, out-of-network allowed amounts and billed charges for covered items and services, and negotiated rates and historical net prices for covered prescription drugs. The machine-readable file requirements of this rule were applicable for plan years beginning on or after January 1, 2022. These regulations were finalized prior to the enactment of the CAA, which contains different (but somewhat overlapping) transparency rules.

With respect to the requirement to make public the machine-readable files for in-network rates and out-of-network allowed amounts and billed charges, for plan years beginning on or after January 1, 2022, the Departments will defer enforcement until July 1, 2022.

TH COMMENT: This is great news for plan sponsors, who seemed unable to obtain contract provisions from third-party administrators (TPAs) that stated the TPA would comply with these rules. Additional time is needed by all parties.

TH COMMENT: These disclosures will be a game changer for health plans. We anticipate that plaintiffs’ lawyers will use this information as the basis to bring lawsuits claiming that plans are overcharging participants for healthcare coverage. Employers can use this information in an RFP process as a way to determine if other similar employer plans pay less for health plan services.

With respect to the requirement to make public the machine-readable files relating to prescription drug pricing, the Departments, recognizing the potentially duplicative prescription drug reporting requirements in the CAA (described later in this article), will defer enforcement until a later, unknown date — and may determine that this reporting is unnecessary in light of the CAA’s reporting

requirements.

TH COMMENT: We are hopeful that drug pricing transparency rules will be issued soon. At this point, how drugs are priced remains in a black box for most employers. This information would allow an employer to compare what its health plan paid for prescription drugs against another employer health plan. Given the difficulties with negotiating with the pharmacy benefit managers (PBMs), this information would be useful in the RFP process.

Transparency in Coverage — Price Comparison Tools & Guidance (ACA and CAA Rules)

The ACA Transparency in Coverage regulations require non-grandfathered group health plans to make price comparison tools available to enrollees through an internet tool and in paper form (upon request). For plan years beginning on or after January 1, 2023, this information must be available with respect to the 500 items and services identified in the regulations; and for plan years beginning on or after January 1, 2024, with respect to all covered items and services. There is no delay for this aspect of the regulation.

Separately, the CAA contains a provision that requires group health plans (both non-grandfathered and grandfathered) to offer price comparison guidance by telephone and to make available on the plan’s website a “price comparison tool” that allows enrollees to compare — with respect to such plan year, such geographic region, and participating providers — the amount of cost-sharing that the individual would be responsible for paying under the health plan for the specific item or service furnished by participating providers. This CAA requirement is applicable with respect to plan years beginning on or after January 1, 2022. However, in recognition of the nearly duplicative requirements of the ACA rule described above, the Departments will delay enforcement of this rule to plan years beginning on or after January 1, 2023 (to align with the effective date of the ACA price comparison tools rule). Through rulemaking, the Departments will consider to what extent compliance with the ACA price comparison tools rules will also be considered as compliance with the CAA price comparison tools rules. The Departments have also stated that they will propose rulemaking requiring that the ACA’s price transparency tools rules be updated to include a requirement that pricing information be available by telephone (to match the CAA’s requirements).

TH COMMENT: Again, plan sponsors will appreciate this delay, as it was not clear if the TPAs would be able to meet the January 1, 2022 deadline.

TH COMMENT: The ACA’s price comparison tools rules do not apply to grandfathered group health plans, whereas the CAA requirements do. The Departments will likely need to address this difference in future rulemaking.

Insurance Identification Card (CAA Rule)

The CAA requires group health plans to include, on any physical or electronic insurance identification card issued to enrollees, any applicable deductibles and out-of-pocket maximums (OOPMs) and a telephone number and website address for individuals to seek consumer assistance. These provisions in the CAA apply with respect to plan years that begin on and after January 1, 2022.

In the FAQs, the Departments stated that they do not intend to issue regulations anytime soon, and that plans are expected to use a good faith, reasonable interpretation of the law until regulations are issued. The Departments stated that they understand that some plans have complex designs with numerous different limits, and that they would not deem a health plan to be out of compliance with the rule if the physical or electronic ID card contained the following: the applicable major medical deductible and applicable out-of-pocket maximum, as well as a telephone number and website address for individuals to seek consumer assistance and access additional applicable deductibles and maximum out-of-pocket limits. Additional deductibles and out-of-pocket maximum limits could also be provided on a website that is accessed through a Quick Response code (QR code) on the card or through a hyperlink, in the case of a digital ID card.

Advanced Explanation of Benefits (CAA Rule)

The CAA requires providers and facilities, upon an individual’s scheduling of items or services, to inquire if the individual is enrolled in a health plan, and to provide a notification of a “good faith estimate” of the expected charges for furnishing the scheduled item or service to the individual’s health plan. Upon receiving a “good faith estimate,” the health plan is, upon request, to send the enrollee an Advanced Explanation of Benefits that includes specific information listed in the statute. These provisions apply with respect to plan years beginning on or after January 1, 2022. Due to the complexity of transferring all of the required data between entities, the Department will defer the enforcement of this rule until regulations are issued. It is unclear when that will occur.

Prohibition on Gag Clauses (CAA Rule)

The CAA prohibits health plans from entering into an agreement with a provider, network or association of providers, third-party administrator, or other service provider offering access to a network of providers that would directly or indirectly restrict the plan from: (1) providing provider-specific cost or quality of care information or data to the plan sponsor, referring providers or enrollees; (2) electronically accessing de-identified claims for each enrollee; and (3) sharing such information with HIPAA business associates. In addition, plans and issuers must annually submit to the Departments an attestation of compliance with these requirements. These provisions are effective December 27, 2020 (the date of enactment of the CAA).

The Departments stated that they will not be issuing regulations to address the prohibition on gag clauses, and there will not be any delayed effective date of this provision. Rather, the Departments believe that the statutory language is self-implementing, and plans are expected to implement the requirements using a good faith, reasonable interpretation of the statute. However, the Departments will issue guidance on how plans must submit their attestations of compliance to the Departments, and they anticipate beginning to collect attestations starting in 2022.

TH Comment: It will be critical for plan sponsors to review agreements with TPAs and others that provide access to a network of providers for these gag clauses. As noted above, plan sponsors will need to send an attestation to the applicable Agency in 2022 that the plans are in compliance with this rule.

Accuracy of the Provider Directory (CAA)

The CAA requires plans to update and verify the accuracy of provider directory information and to establish a protocol for responding to requests by telephone and electronic communication from enrollees about a provider’s network participation status. If an enrollee is furnished an item or service by a nonparticipating provider or nonparticipating facility, and the individual was provided inaccurate information by the plan under the required provider directory or response protocol that stated that the provider or facility was a participating provider or participating facility, the plan cannot impose a cost-sharing amount that is greater than the cost-sharing amount that would be imposed for items and services furnished by a participating provider or participating facility and must count cost-sharing amounts toward any in-network deductible or in-network out-of-pocket maximum. This CAA provision is applicable with respect to plan years beginning on or after January 1, 2022.

The Departments stated that they will not be issuing regulations under this section of the CAA prior to January 1, 2022. Plans are expected to implement these provisions using a good faith, reasonable interpretation of the statute.

TH Comment: We suggest that plan sponsors review agreements with TPAs to ensure that the TPAs will keep directories updated and will indemnify the plan sponsor if there are any increased claim costs due to an inaccurate provider directory.

Continuity of Care (CAA)

The CAA contains protections to ensure continuity of care for certain continuing care patients for a limited period of time when a provider or network contract is terminated. This protection is applicable with respect to plan years beginning on or after January 1, 2022.

The Departments stated that they will not be issuing regulations under this section of the CAA prior to January 1, 2022. Plans are expected to implement these requirements using a good faith, reasonable interpretation of the statute.

Grandfathered Health Plans

The FAQs state that the CAA does not include an exception for grandfathered health plans. Accordingly, the health plan provisions of the CAA are applicable to grandfathered plans.

Reporting on Pharmacy Benefits and Drug Costs

The CAA contains reporting requirements for health plans that primarily relate to prescription drug expenditures. Plans are to provide information to the Departments, such as: (1) the 50 most frequently dispensed brand prescription drugs, and the total number of paid claims for each such drug; (2) the 50 most costly prescription drugs by total annual spending, and the annual amount spent by the plan or coverage for each such drug; (3) the 50 prescription drugs with the greatest increase in plan expenditures over the plan year preceding the plan year that is the subject of the report; (4) total spending by the plan broken down by the type of costs; (5) the average monthly premiums paid by enrollees and paid by employers on behalf of enrollees; (6) the impact on premiums of rebates, fees, and any other remuneration paid by drug manufacturers to the plan or its administrators; and (7) other information specified in the regulation. The Departments are then to issue public reports on prescription drug reimbursements under group health plans, prescription drug pricing trends, and the impact of prescription costs on premium rates, aggregated in such a way that no drug or plan specific information will be made public.

The initial reporting by the health plans to the Departments was to occur December 27, 2021 and then again on June 1, 2022. The Departments will defer the enforcement related to these reports until further guidance is issued. However, the Departments state that they, “strongly encourage plans…to start working to ensure that they are in a position to be able to begin reporting the required information with respect to 2020 and 2021 data by December 27, 2022.”

TH Comment: It will be critical for plan sponsors to review agreements with TPAs and PBMs to ensure that those entities can timely report this information to the applicable Department.

Summary

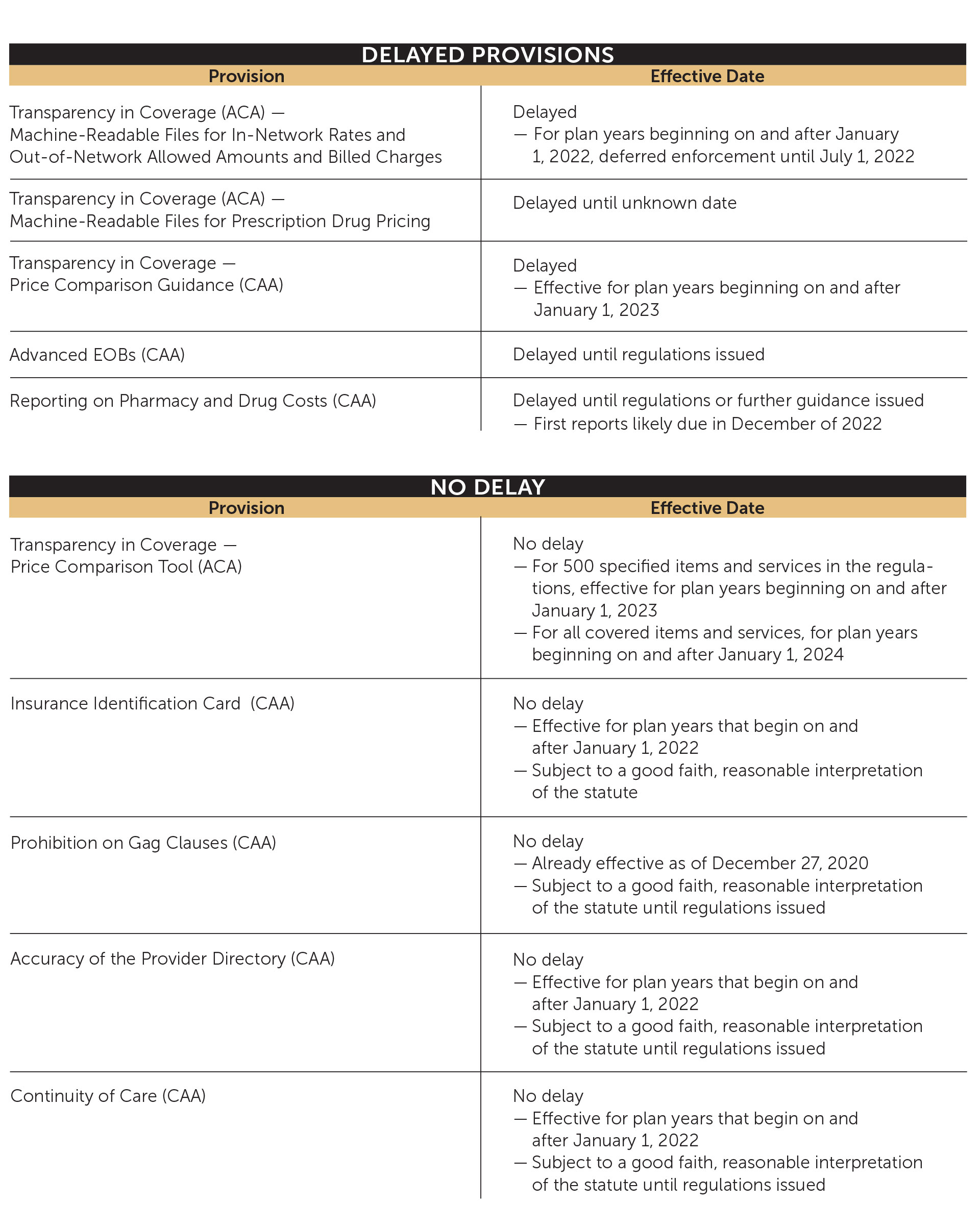

The charts below show which provisions have been delayed and which ones have not.