ANGEL L. GARRETT and BRYAN J. CARD, August, 2019

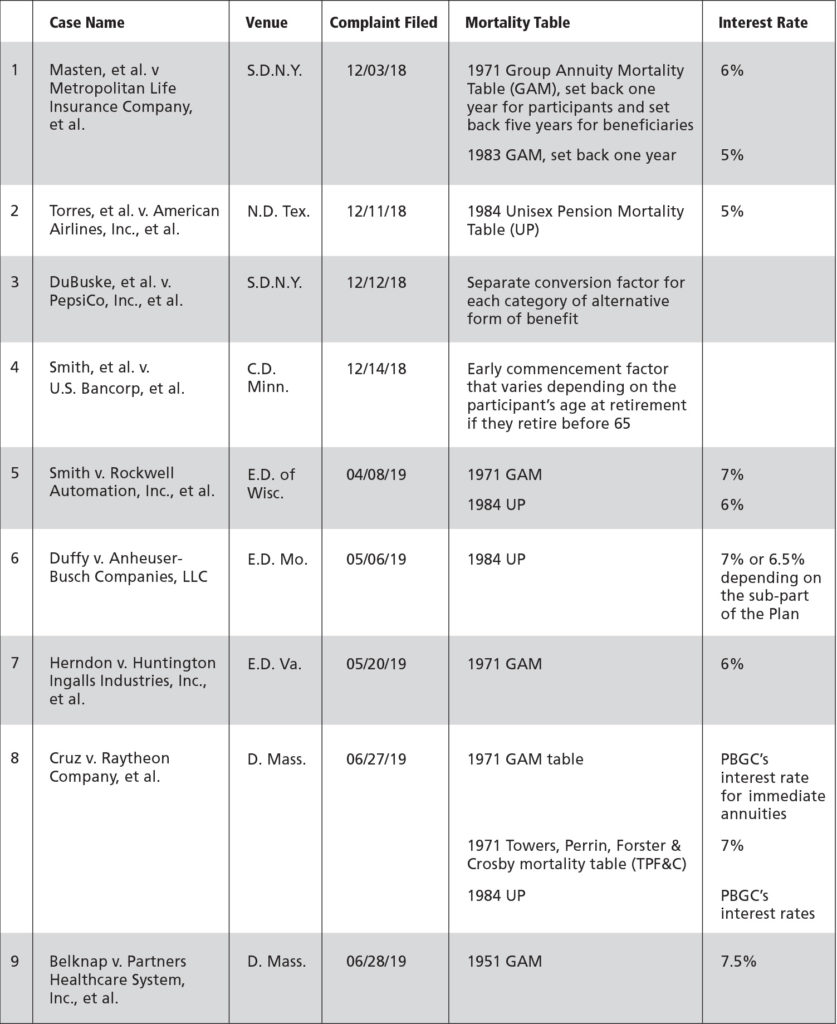

A new wave of putative class-action lawsuits filed under the Employee Retirement Income Security Act of 1974 (ERISA) has emerged onto the scene alleging that companies are using outdated mortality tables from the 1970s and 1980s in calculating alternative forms of benefits under defined benefit plans. Starting with four lawsuits in December of 2018, there are now nine lawsuits, all filed by the same two plaintiff-side law firms against plan sponsors Metropolitan Life Insurance Company (“MetLife”), American Airlines, PepsiCo, U.S. Bancorp, Rockwell Automation, Anheuser-Busch, Huntington Ingalls Industries, Raytheon Company, and Partners Healthcare System, and the plans’ fiduciaries.

All nine lawsuits generally allege that the plans used unreasonable actuarial assumptions when converting the plans’ normal forms of retirement benefit such as a single life annuity, to an alternative form of benefit, such as a joint and survivor annuity. Essentially, plaintiffs allege that the alternative forms of benefit are not actuarially equivalent to the normal form of benefit as required under ERISA and, therefore, some retirees who are participants in the companies’ defined benefit pension plans have lost part of their vested retirement benefits in violation of ERISA section 203(a). The plaintiffs also claim that the plans’ fiduciaries breached their duties in using these alleged outdated mortality tables. Ultimately, the lawsuits seek reformation of the plans, payment of benefits pursuant to the reformed plan’s terms, and payment of improperly calculated and withheld benefits.

Defendants in seven of the cases have filed motions to dismiss, but decisions have been reached inonly two of these motions. The courts in Smith, et al. v. U.S. Bancorp (C.D. Minn.) and Torres, et al. v. American Airlines (N.D. Tex.) denied the defendants’ motions to dismiss. While the plaintiffs may view these denials as victories, this does not indicate that the plaintiffs will prevail at the end of the day as litigation continues and actuarial experts are brought in. Moreover, there are still five motions to dismiss pending — which will likely increase to seven motions if the defendants in the two latest cases file such motions. Because this litigation is still in the early stages, it is unclear how significant a threat these lawsuits may prove to be, but given the increase in the number of lawsuits filed and the spread of these cases among six circuits — the First, Second, Fourth, Fifth, Seventh, and Eighth Circuit — plan sponsors should take a close look at their plan document, specifically the interest rate and mortality table specified in the plan document.

As shown in the following chart, the plaintiffs in these lawsuits attack the use of various actuarial assumptions as unreasonable.

Actuarial Equivalence in a Defined Benefit Plan

Under the Internal Revenue Code (IRC), the plan document for a defined benefit plan must specify the plan’s normal form of benefit, which must be expressed in the form of an annuity commencing at normal retirement age.1 In most plans, the normal form of benefit is a single life annuity (SLA). In addition to the normal form of benefit, most defined benefit plans also offer a variety of alternative forms of benefit. Some of the more common alternative forms of benefit are the qualified joint and survivor annuity, certain and life annuities, and early retirement. Participants, regardless of the form of benefit they choose at retirement, accrue their benefit under the plan’s normal form of benefit.2

If a participant at retirement elects an alternative form of benefit, then the accrued normal form of benefit must be converted to the alternative form of benefit, which must have a present value that is actuarially equivalent to the plan’s normal form of benefit.3 This conversion is accomplished through the application of the plan’s actuarial assumptions that are based on mortality tables and interest rates (or a table of adjustment factors, e.g., early retirement factors), and those must be stated in the plan document.4 The actuarial assumptions are then used to determine a conversion factor which is applied to the normal form of benefit to calculate the value of the alternative form of benefit.

Summary of Defendants’ Motions to Dismiss

While all of the defendants advanced arguments specific to the facts and circumstances of their own case, below are the defendants’ general arguments.

- The actuarial assumptions used by the plans are not unreasonable. The mortality tables at issue (e.g., 1971 GAM) are standard mortality tables under IRC regulations for nondiscrimination testing purposes and, therefore, are reasonable. In addition, the defendants argue that the alternative form of benefit and the normal form of benefit are “approximately equal in value” as set forth under IRC regulation C.F.R. § 1.417(a)(3)-1(c)(2)(iii)(C). These regulations governing “relative value” expressly state that a difference of five percent or less in value is deemed to be “approximately equal in value.” Furthermore, the interaction between the mortality table and the interest rate allows for the interest rate to offset allegedly outdated mortality assumptions.

- ERISA does not require that actuarial assumptions be “reasonable.” ERISA sections 203 and 205, 29 U.S.C. sections 1053 and 1055, do not require that plans use “reasonable” actuarial factors for calculating joint and survivor annuities.

- Congress could have required plans to use “reasonable” actuarial assumptions but it did not. Congress does require the use of reasonable actuarial assumptions, but not for the purpose for which the plaintiffs allege. IRC Section 1085(a) requires that plans use reasonable actuarial assumptions for funding purposes. Also, IRC Section 1393(a)(1) specifies that, for determining withdrawal liability in the aggregate, reasonable actuarial assumptions must be used. However, no such requirement is found with respect to the calculation of alternative forms of benefit.

- There is no independent private right of action to enforce IRC Regulations. Plaintiffs’ claim must be dismissed because there is no independent private right of action to enforce the IRC regulations on which the plaintiffs rely.

- The claims are barred by ERISA’s statute of limitations. ERISA states that no fiduciary breach claim may be brought six years after the “the date of the last action which constituted a part of the breach or violation.” The plaintiffs received information regarding the actuarial assumptions more than six years from the date of the complaint.

- There is no viable claim for breach of fiduciary duty. There is no breach of fiduciary duty because plan design is a settlor decision, not a fiduciary decision.

Next Steps for Plan Sponsors

While awaiting a more definitive outcome in these cases, plan sponsors should review the interest rates and mortality table specified in their defined benefit plan documents. In addition to providing updates to plan sponsors, Trucker Huss is also available to assist with this analysis.

______________________

1 IRC Section 411(a)(7)(A)(i).

2 IRC Section 411(a)(7)(A)(i).

3 ERISA Section 204(c)(3), IRC Section 411(c)(3).

4 IRC Section 401(a)(25).