SHANNON OLIVER, November 2017

On October 19, the Internal Revenue Service issued Notice 2017-64, containing the cost-of-living adjustments applicable to retirement plan limitations under the Internal Revenue Code (the “Code”). These changes will take effect on January 1, 2018, and are based on the fact that the Consumer Price Index increased by 2.2% last year. Many of the limitations are being increased, while others remain unchanged. Below is a summary of some of the more important limitations.

Limitations Increased

- The limitation on the annual benefit under a defined benefit plan is increased from $215,000 to $220,000 (Code section 415(b)(1)(A)).

- The annual contribution limitation for defined contribution plans is increased from $54,000 to $55,000 (Code Section (415(c)(1)(A)).

- The annual deferral limit for 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan are increased from $18,000 to $18,500 (Code sections 402(g)(1),402(g)(3)).

- The annual compensation limit is increased from $270,000 to $275,000 (Code sections 401(a)(17), 404(l),408(k)(3)(C) and 408(k)(6)(D)(ii)).

- The dollar limitation for determining the maximum account balance in an employee stock ownership plan subject to a 5-year distribution period is increased from $1,080,000 to $1,105,000, whereas the dollar amount used to determine the lengthening of the 5-year distribution period is increased from $215,000 to $220,00 (Code section 409(o)(1)(C)(ii)).

- The limitation concerning the qualified gratuitous transfer of qualified employer securities to an employee stock ownership plan is increased from $45,000 to $50,000 (Code section 664(g)(7)).

- The annual deferral limit for deferred compensation plans of state and local governments, and tax-exempt organizations is increased from $18,000 to $18,500 (Code section 457(e)(15)).

- The compensation threshold pertaining to the definition of “control employee” for fringe benefit valuation purposes is increased from $105,000 to $110,000, and the compensation limitation is increased from $215,000 to $220,000 (Regs. sections 1.61-21(f)(5)(i) and 1.61-21(f)(5)(iii)).

- The dollar limitation on premiums paid with respect to a qualifying longevity annuity contract is increased from $125,000 to $130,000. (Code section 1.401(a)(9)-6 and Regs. section A-17(b)(2)(ii)).

- The threshold used to determine whether a multiemployer plan is systemically important is increased from $1,012,000,000 to $1,087,000,000 (Code sections 432(e)(9)(H)(v)(lll)(aa) and 432(e)(9)(H)(lll)(bb)).

Limitations Unchanged

- The annual compensation threshold for purposes of the definition of “key employee” remains at $175,000 (Code section 416(i)(1)(A)(i)).

- The annual deferral limitation for SIMPLE retirement accounts remains at $12,500 (Code section 408(p)(2)(E)).

- The maximum amount of catch-up contributions that individuals age 50 or over may make to SIMPLE 401(k) plans or SIMPLE retirement accounts remains at $3,000 (Code section 414(v)(2)(B)(ii)).

- The compensation threshold for simplified employee pensions (SEPs) remains at $600 (Code section 408(k)(2)(C)).

- The maximum amount of catch-up contributions that individuals age 50 or over may make to 401(k) plans, 403(b) plans, SEPs and governmental 457(b) plans remains at $6,000 (Code section 414(v)(2)(B)(i)).

- The maximum amount the can be contributed to an IRA remains at $5,500. The IRA catch-up contribution limit for IRAs remains unchanged at $1,000 (Code section 219(b)(5)(A)).

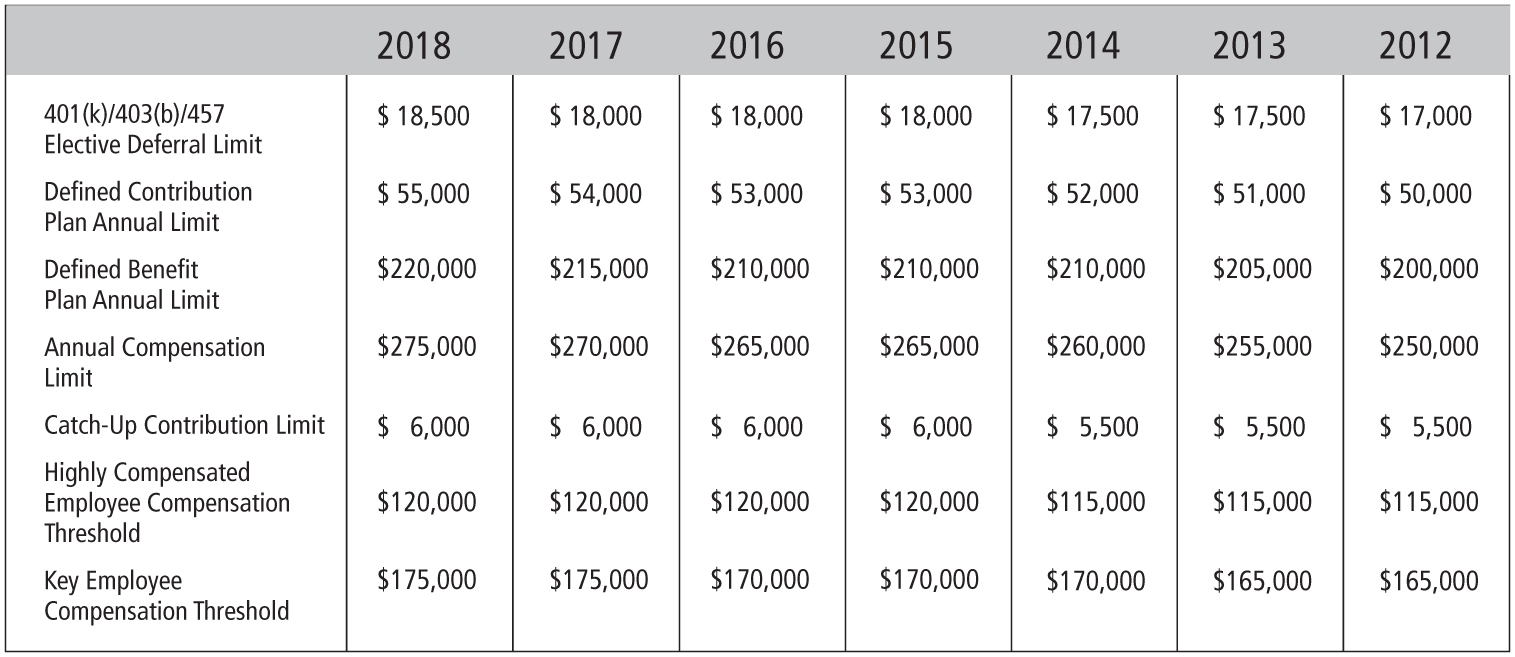

The following chart is a quick reference guide to key limitations for 2012 – 2018