GISUE MEHDI, September 2016

Background

In general, when a distribution from an individual retirement arrangement (“IRA”) or a retirement plan is paid directly to an individual, the individual has 60 days from the date on which he or she receives the distribution to roll it over to another plan or IRA, in order to qualify for tax-free rollover treatment. The Internal Revenue Service (“IRS”) may waive the 60-day rollover requirement in certain situations if an individual missed the deadline because of circumstances beyond his or her control. In the past, the IRS has provided two ways for individuals to make a late rollover contribution: (1) if they satisfied the requirements to be entitled to an automatic waiver of the 60-day rollover requirement, or (2) if they requested and received a private letter ruling from the IRS waiving the 60-day requirement.

Revenue Procedure 2016-47

On August 24, 2016, the IRS issued Revenue Procedure 2016-47, providing taxpayers with a third way to obtain a waiver of the 60-day rollover requirement. In Rev. Proc. 2016-47, the IRS provides guidance for a self-certification procedure to help taxpayers who receive distributions but inadvertently miss the 60-day limit for rolling these amounts into another retirement plan or IRA. It provides that a plan administrator, or an IRA trustee, custodian, or issuer (“IRA trustee”), may rely on the taxpayer’s self-certification for the following eleven (11) reasons for making a late contribution:

- The financial institution making the distribution or receiving the contribution made an error;

- The distribution, having been made in the form of a check, was misplaced and never cashed;

- The distribution was deposited into an account that the taxpayer mistakenly thought was a retirement plan or IRA;

- The taxpayer’s principal residence was severely damaged;

- A member of the taxpayer’s family died;

- The taxpayer or a member of the taxpayer’s family was seriously ill;

- The taxpayer was incarcerated;

- A foreign country imposed restrictions;

- The post office made an error;

- The distribution was made on account of a levy under Sec. 6331, and the proceeds of the levy have been returned to the taxpayer; or

- The party making the distribution delayed providing information that the receiving plan or IRA required to complete the rollover, despite the taxpayer’s reasonable efforts to obtain the information.

Self-Certification

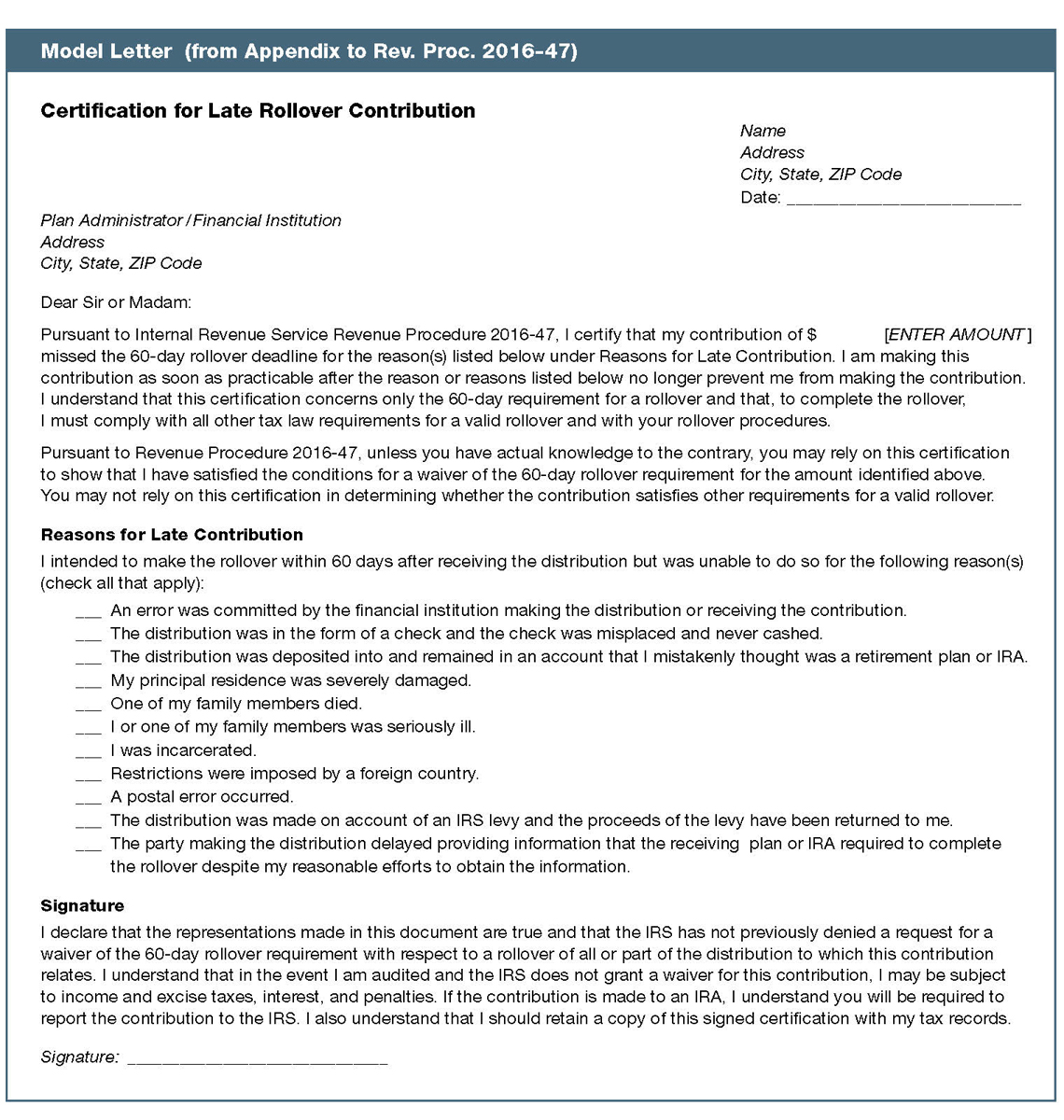

To self-certify that he or she qualifies for a waiver, the individual must complete the Model Letter in the appendix to Revenue Procedure 2016-47 on a “word-for-word basis or by using a letter that is substantially similar in all material respects” and present it to the plan administrator or financial institution receiving the late rollover contribution. (See the Model Letter at the end of this article.) The individual will be entitled to a waiver if all of the following requirements are met:

- The rollover contribution satisfies all of the other requirements for a valid rollover (excluding the 60-day rollover requirement).

- The individual can show (if challenged) that one or more of the eleven (11) reasons listed above (from the Model Letter in Rev. Proc. 2016-47) prevented him or her from completing a rollover during the 60-day period.

- The distribution came from the individual’s IRA or retirement plan.

- The IRS has not previously denied the individual’s request for a waiver.

- The rollover contribution is made to the plan or IRA as soon as practicable after the reason or reasons for the delay no longer prevent the individual from making the contribution (completing the rollover within 30 days satisfies this requirement).

- The representations made by the individual in the Model Letter are true.

Self-certification is easier than requesting a private letter ruling for a waiver, because the taxpayer does not have to file a request with the IRS, pay a fee to the IRS, or wait to receive a letter ruling from the IRS before making the late rollover contribution.

It is important to note that submitting a completed Model Letter (or similar letter) to a plan administrator or financial institution does not, in itself, constitute a waiver by the IRS of the 60-day rollover requirement. The taxpayer should keep a copy of the certification, in case it is requested on audit. If the IRS later audits the individual’s income tax return, the IRS may determine upon examination that the taxpayer does not qualify for a waiver, in which case he or she may be subject to taxes and penalties.

Next Steps for Plan Administrators

For purposes of accepting and reporting a rollover contribution into a plan or IRA, a plan administrator or IRA trustee may rely on a taxpayer’s self-certification in determining whether the taxpayer has satisfied the conditions for a waiver of the 60-day rollover requirement. However, a plan administrator or an IRA trustee may not rely on the self-certification for any other purposes or if the administrator has actual knowledge that the information in the self-certification is not true. Currently, the IRS has not elaborated on what constitutes “actual knowledge” that the self-certification is not true, or how a plan administrator would obtain or rely on such information. This could require the implementation of a new administrative process or monitoring by plan administrators.

In light of the changes made by Revenue Procedure 2016-47, plan administrators should also consider revising their 402(f) notices. The model notices under section 402(f) that can be provided to participants with an eligible rollover distribution are located at the end of IRS Notice 2009-68. The section on “If you miss the 60-day rollover deadline,” only discusses applying for a waiver by filing a private letter ruling request with the IRS. This should be updated to reflect the possibility of self-certification.

Conclusion

Rev. Proc. 2016-47 continues the IRS trend to reduce the burden on IRS resources as evidenced by the IRS’s decision to eliminate the determination letter application program, previously discussed in an article in the August issue of our newsletter, titled “Internal Revenue Service Provides Guidance on the Scope of the New Determination Letter Program for Individually Designed Plans.”

Further, Rev. Proc. 2016-47 is consistent with the movement toward liberalizing the acceptance of rollovers from another plan or IRA, discussed in greater detail in Revenue Ruling 2014-9. Rev. Rul. 2014-9 provides guidance on rollovers to qualified plans and examples of “due diligence” procedures plan administrators may rely on when accepting rollovers into the plan.

Rev. Proc. 2016-47 is effective as of August 24, 2016. The impact of the revenue procedure may remain unclear for some time, as plan administrators and IRA custodians are not required to accept the self-certification. Although self-certification is a less burdensome and less costly option than obtaining a private letter ruling, taxpayers should weigh the amount at stake, the specific circumstances surrounding the failure to complete the 60-day rollover, whether the administrator will accept self-certification, and the fact that the IRS can still reject the self-certification upon audit.

Finally, we suggest plans accept self-certifications because it gives plans a welcome opportunity to be flexible (i.e., lenient) in situations beyond a participant’s control and because Rev. Proc. 2016-47 provides that a plan administrator may rely on the taxpayer’s certification in accepting and reporting receipt of a rollover contribution.

If you have questions or need assistance, please contact the author of this article or the Trucker Huss attorney with whom you normally work.